Sino-German BioEnergy Annual Conference 2024

Green Gas · Green Economy · Green Development23-25 October 2024 · Fuyang, Anhui Province

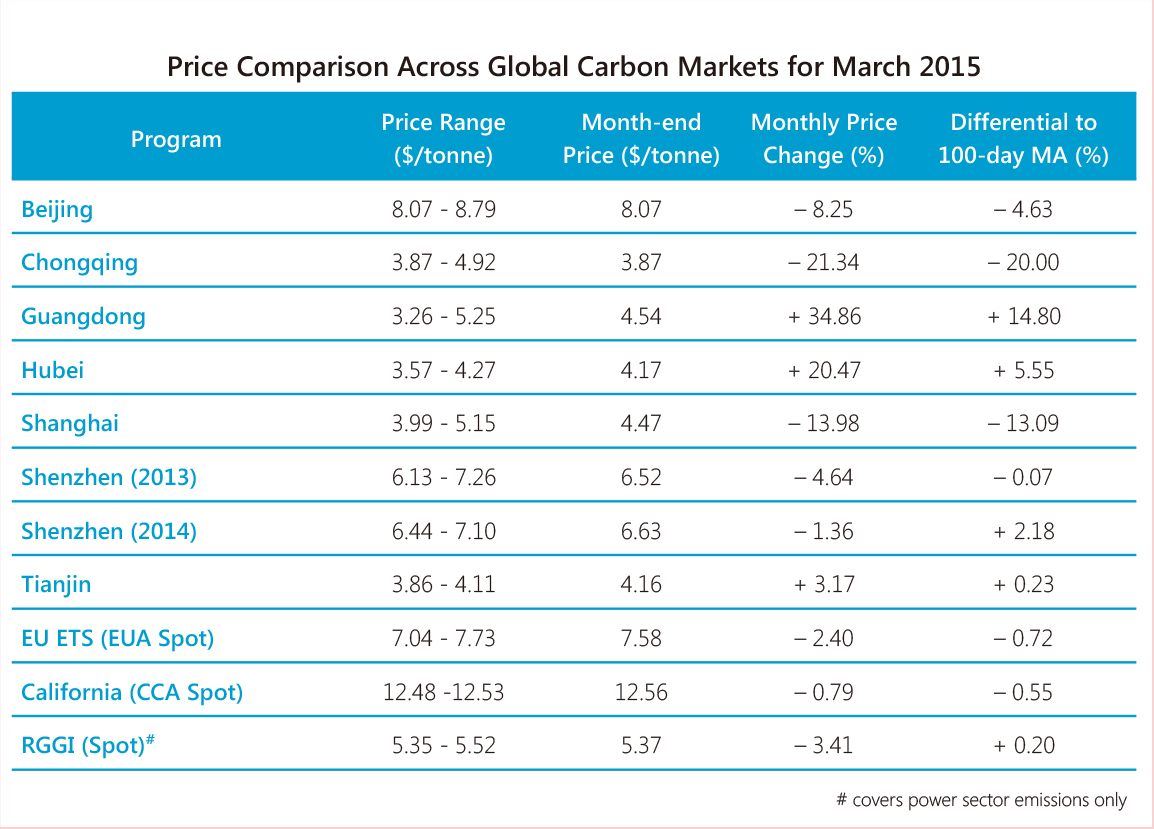

Almost all pilot carbon markets saw record-setting trading in March. Huge volumes were traded amidst volatile prices. The reason for this frantic run to the exchange by traders and covered entities was the announcement of compliance timelines by various regulatory bodies. Hubei and Guangdong announced compliance timelines for their covered entities, starting with the submission of greenhouse gas inventories for 2014. Beijing took the lead in this regard with all 190 covered entities submitting their emissions reports. These reports will now go for third-party verification.

Traded volume in Beijing was higher than short-term as well as long-term technical indicators on most of the trading days. The price remained volatile albeit in a narrow range. Traded volume last month was more than twice what it was in February 2015 and more than four times the volume traded in March 2014. Similar trends were seen in Shanghai where the traded volume remained above the 150-day moving average during all but six trading sessions. Total traded volume crossed 200 000, which is equivalent to more than a third of the total volume traded in entire calendar year of 2014.